This COVID experience taught us that no one lives forever, and the importance of certain tasks: insurance, heirship decisions, donations. Situations call us to act from our center, and we increasingly call our homes our center. Take time NOW to tackle some of those ‘home jobs.’

This COVID experience taught us that no one lives forever, and the importance of certain tasks: insurance, heirship decisions, donations. Situations call us to act from our center, and we increasingly call our homes our center. Take time NOW to tackle some of those ‘home jobs.’

Last week’s practical methods for HOMEWORK talked about the ins and outs of donations. This week I discuss proper ways to insure (or review your insurance) of your belongings and tactics for evaluating household valuables to distribute after death.

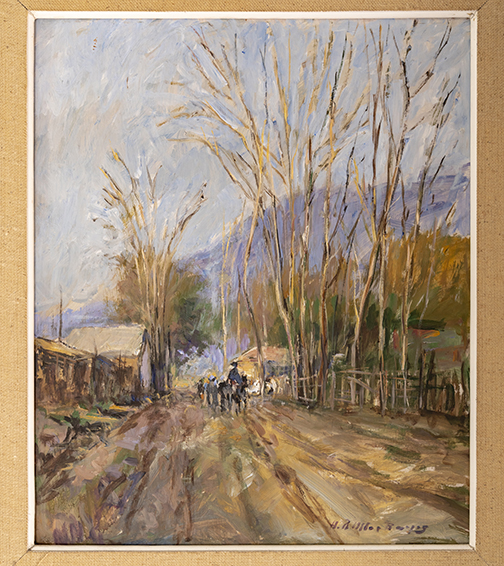

Now consider the objects you should keep for your heirs. These objects matter to your family. How do you impress upon your children, especially your grown children, that these objects matter? I often lecture on my book No Thanks Mom: The Top Ten Objects Your Kids Do Not Want. Folks laugh and identify with the mention of those objects you inherited but your kids turned down. Fine formal china, Persian rugs, steamer trunks, silverplate, old photos and letters, books, figurines, heavy antique furniture, ancestor paintings. How do you curate these objects so when you leave this planet, your family understands they matter?

Use the language of the times: technology

Photograph the object and make an archive on your computer where you describe the object. “This grandfather clock went around the Horn with Great-great-grandpa Horace, in 1873,” for example. Communicate the importance of objects by telling their story. Without a narrative, what we call a “provenance,” the object becomes voiceless. As an appraiser who employs a professional photographer and videographer, we offer a service overrun with requests these days. We call it “Safe Tapes,” a recording of the head of the household reciting the provenance and importance TO THEM of valued objects in the home. THESE BITS OF TECHNOLOGY ARE SHARED WITH HEIRS.

Photograph the object and make an archive on your computer where you describe the object. “This grandfather clock went around the Horn with Great-great-grandpa Horace, in 1873,” for example. Communicate the importance of objects by telling their story. Without a narrative, what we call a “provenance,” the object becomes voiceless. As an appraiser who employs a professional photographer and videographer, we offer a service overrun with requests these days. We call it “Safe Tapes,” a recording of the head of the household reciting the provenance and importance TO THEM of valued objects in the home. THESE BITS OF TECHNOLOGY ARE SHARED WITH HEIRS.

Another way to curate for your heirs with a professional on hand (remember appraisers look at objects in a certain way) is to simply press “video” on your phone and take a tour around your home. Stand before objects that matter and tell us why. Recite all you know about the object. Speak of a value besides monetary value, because as trends change, monetary value changes. Keep this archive somewhere not in your house.

Make time to inventory NOW

The inventory first serves your heirs. The MOST valuable objects should be discussed with your Trust and Estate Attorney. They might suggest you give objects away, but retain them in your home, before you leave this planet. Remember the impact of capital gains. A word with your tax attorney might be prudent if you own something of extremely value.

Also at this time discuss with your tax attorney, in the situation of ownership of a great painting, for example, about the nature of what constitutes items bequeathed in your will that flow through into your living trust.

Also at this time discuss with your tax attorney, in the situation of ownership of a great painting, for example, about the nature of what constitutes items bequeathed in your will that flow through into your living trust.

Of course, since I’m an appraiser, now is a great time to order an appraisal. I often write appraisals for “Equitable Distribution” which means I go through your collections, identify fine art and objects d’art over a certain value, let us say over $1,500 each. I write about each, giving provenance and value in the current marketplace. At the end of this process you and me and sometimes your trust attorney earmark selected and equally valued groups of objects to go to your heirs. Now you have avoided the fighting I always witness among heirs.

An inventive client of mine explored another way to think about equitable distribution. After I wrote her appraisal, she hired my professional photographer to do a professional video of her walking through her home and describing each piece of value. John made three copies of her collection on a CD, mailed to each of her 3 kids, and of course we stored her archive in the CLOUD, too.

She moved, so she wrote to her kids, “All the objects on this video will be in storage and insured for Elizabeth’s appraised value. At the end of three months, I will stop payment on the storage and Clar’s Auctions will take everything. Tell me what you want. (By the way, she didn’t share my dollar figure valuations of 60 objects with her three kids!) The first to send me a list of 20 objects will get those 20 objects. The other two of you will then choose among what remains. You will then hire a truck and collect those objects. I’ve added each of you as alternate renters to the storage unit. I suggest you speak to your siblings about this arrangement, but not me. I’ve done my part to honor these heirlooms to be passed, or not passed, to you.”

Distributing to Heirs

If you don’t distribute in my client’s aggressive way, you might ask, “Elizabeth, around the kid’s conference table, how do I designate who gets first choice of the objects?” Begin such a conference by letting the heirs see the dollar figures on my appraisal. At the end of the day, each sibling’s gifted amount is similar. But who picks first? Either you go by age, or they draw straws, as simple as that. The executor doesn’t go first or choose who goes first if YOU specify the selection method.

One technique, tried and true, designed for these days when grown children do not want much of anything. You sell everything, and distribute the cash, as specified in your will. Or you specify in your will that equality is the most important factor in distribution of valued objects. And you state: “in the event that one sibling wants nothing, the other siblings will pay them the dollar amount of the objects retained.”

One technique, tried and true, designed for these days when grown children do not want much of anything. You sell everything, and distribute the cash, as specified in your will. Or you specify in your will that equality is the most important factor in distribution of valued objects. And you state: “in the event that one sibling wants nothing, the other siblings will pay them the dollar amount of the objects retained.”

This often becomes difficult, because let us say you own a valuable work of art by a living artist, and I set the value when I write your appraisal. When you leave the planet, this artist since died, and we all know values jumps when an artist dies. So specify in concert with your trust attorney WHEN a work of art is to be valued, AND THERE ARE RULES FOR THIS.

Think about these things NOW because these past five months have shown us no one lives forever. My trust attorney friends are swamped with work because of this prevailing sentiment. Also, I myself have done hundreds of “distance” appraisals accomplished via photographs. The how-to of this distance valuation is now legislated by the Appraisal Foundation of Washington, DC. A good appraiser CAN do much with photographs. Please see my article about how to shoot for an appraiser.

How to Insure Your Objects

First, read your policy or speak to your agent/broker. I’m surprised how many people do NOT. I suggest you ask:

- What scheduled rider coverage looks like.

- How MUCH your homeowner’s policy covers for household jewelry, silver, electronics, various categories of objects.

- What the “contents” coverage is, because the categories I mentioned stand outside of the contents coverage.

- What “depreciable” merchandise means, and the definition of “appreciable” contents.

- If you are covered for actual cash value, replacement cost – NEW or USED, or market value. All these are very different in the case of a loss.

The best insurance covers replacement cost new, but that gives insurance company wiggle room. How do you receive reimbursement for an 18th century Chippendale settee when it cannot be purchased new? The most important question is what appreciable objects should be scheduled, and what the “floor” is, value wise, for scheduling? For example, my broker suggests I schedule all appreciable fine art over $1,500. Here’s a kicker, the definition of fine art varies by insurer.

The best insurance covers replacement cost new, but that gives insurance company wiggle room. How do you receive reimbursement for an 18th century Chippendale settee when it cannot be purchased new? The most important question is what appreciable objects should be scheduled, and what the “floor” is, value wise, for scheduling? For example, my broker suggests I schedule all appreciable fine art over $1,500. Here’s a kicker, the definition of fine art varies by insurer.

One client family felt pleased to discover after the fires that fine art included their ethnic collection of Navajo rugs. Not every client felt as pleased with what their insurer thought of as fine art. Another dismayed client found out “collectibles” and “fine art” were two different categories. So take time NOW to ask for terms, definitions, and examples.

Insurance Appraisal

I’m a big fan of separate rider policies with a separate insurer from your homeowner’s policy, plus an umbrella policy that covers all my other liabilities. I encourage you to ask for an appraiser review of your last appraisal for insurance purposes. If you haven’t updated your contents and rider coverage in the last three years, even if the policy specifies that each year the ‘cost of living index’ percentage applies, that doesn’t matter much in certain categories of objects. The market undoubtebly CHANGES. Take time to NOW to speak with your appraiser about the fluctuations in the market for high-end merchandise.

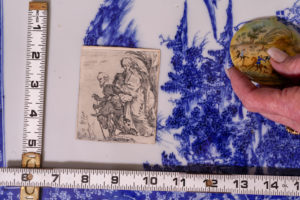

Now take the inventory you made for your heirs and fancy it up for your insurance. Take photos or make a video much the same for your insurance. However, consider the fine shade of difference for this purpose. For insurance your photos or videos should always include scale (relative size) so take a measuring stick with you when you tour your home. Those photos NEED to include YOU in the image, as well as the setting of the work of art. The basis of all claims is that you owned that object at that location.

Now take the inventory you made for your heirs and fancy it up for your insurance. Take photos or make a video much the same for your insurance. However, consider the fine shade of difference for this purpose. For insurance your photos or videos should always include scale (relative size) so take a measuring stick with you when you tour your home. Those photos NEED to include YOU in the image, as well as the setting of the work of art. The basis of all claims is that you owned that object at that location.

Ask your insurer if your homeowner’s policy includes your storage locker. If you allowed your storage facility to insure the objects, you’re pretty much sunk in the case of a loss. If you never acquired an appraisal of certain objects for insurance purposes, ask for an insurance appraisal now. You might say, I HAD an appraisal for Trust and Estates purposes, BUT insurance valuation methodology is different from your appraisal for equitable distribution, trust, or donation purposes.

Same Inventory, Different Value

Insurance appraisals use replacement cost (think retail value) verses trust appraisals which use fair market value (the most common price paid – think auction market). Most families ask me to write both an estate appraisal and an insurance appraisal at the same sitting. The inventory reads the same, but the values change. This costs my client less because I simply research two markets for value, and don’t need to write two inventories. Again, you direct what I list. For example, “Elizabeth, my insurer wants all fine art and all collectibles scheduled over $1,500,” and “Elizabeth, my heirs are interested in your opinion of fair market value on all objects with a fair market value over $2,000.”

I like to say you can never be too flippant about insuring your valuables. At this very moment I’m an expert witness appraiser in a 2017 fire court case. So I know that generally the insurance companies prevail. You probably noticed that most impressive buildings in any major city are always the headquarters of insurance companies.

Now you most assuredly have your homework, literally. As we clean up our homes, and curate wisely, let me help you re-form your HOMEWORK!